Most Tesla cars purchased after December 31 2019 do not qualify for the credit. In July Tesla hit their 200000 the car delivered meaning that any Tesla delivered in Q3 or Q4 the remainder of 2018 will be eligible to receive that 7500 rebate.

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

You must purchase the EV to get both.

Does tesla 3 qualify for tax credit. Both versions of the Model 3 are now listed as eligible vehicles for the 5000 tax credit on Transport Canadas website. Plug-In Electric Drive Vehicle Credit IRC 30D November 30 2009 The new qualified plug-in electric drive motor vehicle credit phases out for a manufacturers vehicles over the one-year period beginning with the second calendar quarter after th. Similarly some vehicles from Cadillac and Chevrolet do not qualify due to the production numbers.

As for Tesla it would earn partial credit for assembling the Model Y and Model 3 in the US though its workforce is not unionized. The tax credit will drop by 50 two quarters. In 2019 more than 320000 plug-in electric vehicles were sold according to the US.

Delivered from January 1 to June 30 2019. On Thursday Tesla TSLA - Get Report CEO Elon Musk tweeted to. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program.

If you are referring to the US Federal Tax Credit then no. Gain a global economic perspective to help you make informed business decisions. Select utilities may offer incentives.

Unfortunately you dont qualify for the federal rebate. Even if you didnt get the full Model 3 tax credit at the end of last ear you will still receive a portion of the Federal EV Tax Credit if delivery is made in 2019. The American car manufacturer Tesla no longer qualifies.

Energy Tax Credits. Note that any tax credit you may receive isnt reflected in the price. Some of the most popular all electric vehicles were from Tesla including the Model 3 Model X and Model S with the Model 3 selling almost 300000 units in 2018 and 2019 combined.

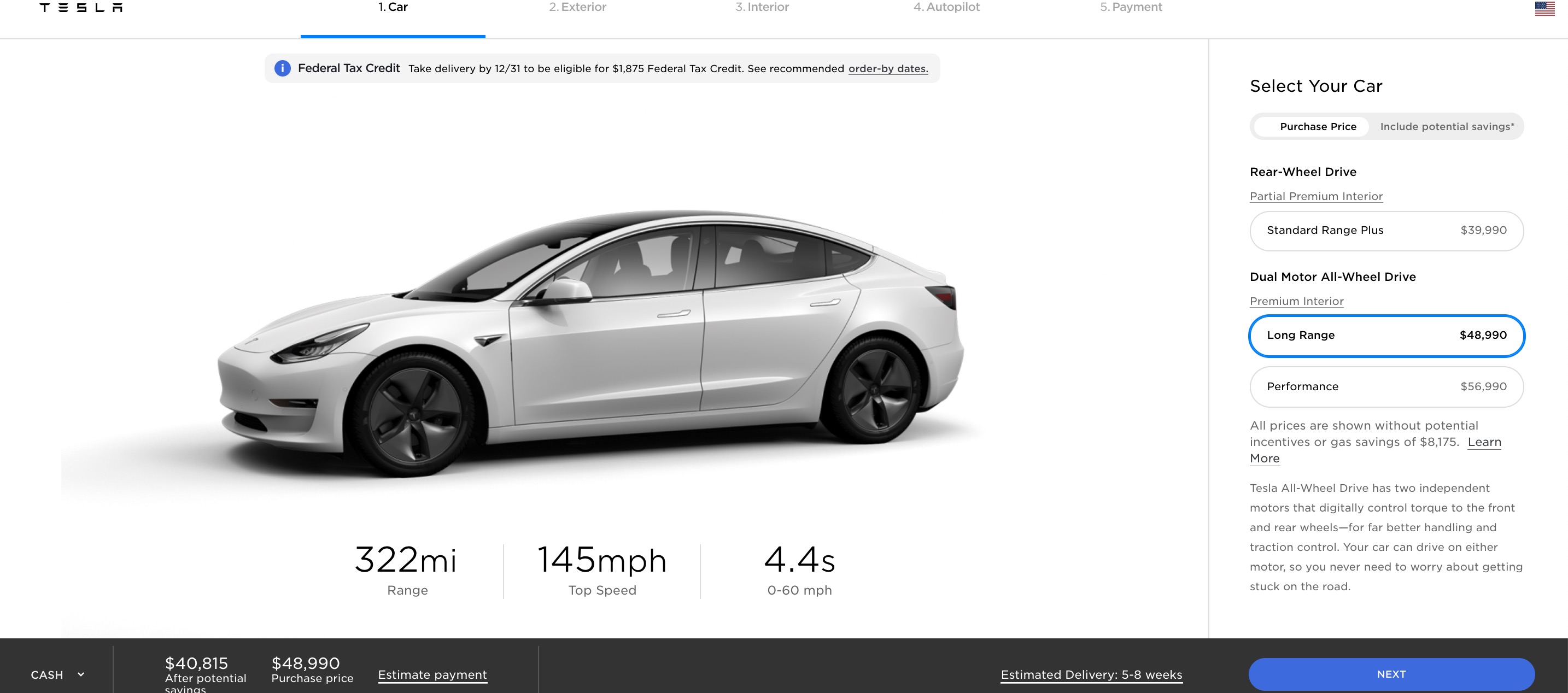

By 2020 the subsidy will be zero dollars for Tesla. You pay full price then get the money back on your next tax. Anyone taking delivery of any Tesla after the end of 2018 is probably going to get at best a small 1875 tax credit or more likely - no tax credit at all.

2000 or 4500 rebate based on income eligibility for Model 3 and Model Y Review eligibility prior to applying. But if the tax credit is still available for Tesla cars at the time you take delivery of your Model 3 then you can deduct up to 7500 from your income tax liability that year. Vehicle will receive the full 7500 federal tax credit.

Entry level model S starts at 79690 Model 3 starts at 39690 Model Y starts at 51990. When you lease an EV in California you qualify for the 2500 state rebate. The credit would only apply to whoever purchased the car new.

Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31. This makes leasing an attractive option for consumers since the credit plays no part in purchase consideration. Tesla can still get customers a Model 3 delivered before the end of the year ensuring they get the full 7500 federal tax credit.

However the Asian car makers Toyota Nissan and Kia all do. If I had to guess it would be that Tesla is eligible for the 7500 credit whenif the bill passes and then the extra 2500 will only be applicable for vehicles sold after January 1 2022. Teslas Model 3 is a top seller and the automaker is ineligible for tax credits.

1500 California Clean Fuel Reward for all new electric vehicles registered in California. Delivered on or before December 31 2018. In addition the tax credit was not eligible for used cars.

For example US automaker Tesla topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax credit at least for now. I just trying to get an idea of how that will work. Tesla has actually hit their 200000 are delivered in the US so this tax credit is going to begin to its phase-out period.

The Model 3 Performance s price remains unchanged at 56990. See California Self-Generation Incentive Program filed on behalf of the customer. First here are some Tesla vehicles that will qualify for the Tax Credit.

Long investor and owner of a Model 3 Tesla. Model 3 buyers who receive their cars in the quarter when Tesla delivers its 200000th US. More Tesla deliveries sooner means Q4 2018 and Q3 2018 and later deliveries in that order are more likely to get a lower tax credit but will probably get one even if only half the 7500 rate.

The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec. EV federal tax credit. Heres the full schedule for Tesla.

When we are able to configure our cars will Tesla let us know that we qualify for the tax credit the full 7500 or less. A few other major changes come with this bill too. Just wanting to see if anyone knows how we would know if we qualify for the tax credit when purchasing the Model 3.

Charged Evs Proposed Legislation Would Restore Federal Ev Tax Credit To Gm And Tesla Charged Evs

Tesla S Canadian Compliance Car Is 94 Mile Model 3 A Clever Workaround Or Silly Business

The Looming Issue With Tesla S Model 3 Production Delay Greentech Media

Tesla Increases Price Of Model 3 As Federal Tax Credit Ends Electrek

Tesla Model 3 Buyers Might Not Get Full Ev Tax Credit News Car And Driver

New Republican Bill Could Remove Federal Tax Credit Cap For Evs After Tesla Hits 200k Electrek

Tesla Model 3 Standard Range Plus 2019 2020 Price And Specifications Ev Database

Tesla To Sell 200 000th Ev In U S In 2018 Tax Credit Phase Out Follows

Tesla To Get Access To 7 000 Tax Credit On 400 000 More Electric Cars In The Us With New Incentive Reform Electrek

Tesla Updates Model 3 Prices As Federal Ev Tax Credits Expire Roadshow

Ev Tax Credits Jump To 12 500 In Proposed Bill Roadshow

Tesla Model 3 Standard Range Plus 2019 2020 Price And Specifications Ev Database

Plug In Electric Vehicles In The United States Wikipedia

Plug In Electric Vehicle Wikipedia

Tesla Gm Lose Bid To Raise Ceiling For Federal Ev Tax Credit

Tesla Shares Fall 7 6 Following Price Cuts In China And Elon Musk S Promise To Reimburse Missed Tax Credits Techcrunch

Can You Really Shave 25 000 Off The Price Of An Electric Car

Tesla Cuts Model 3 Price In Canada So Buyers Can Government Tax Credit

Post a Comment

Post a Comment